where does your credit score start canada

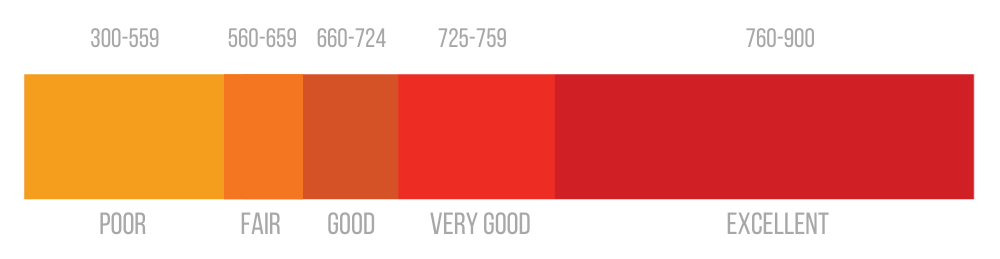

In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a. How to Check Your Credit Score.

What Your Credit Score Range Really Means In Canada Loans Canada

Its essential to keep your score on the high end of the scale but where do you start.

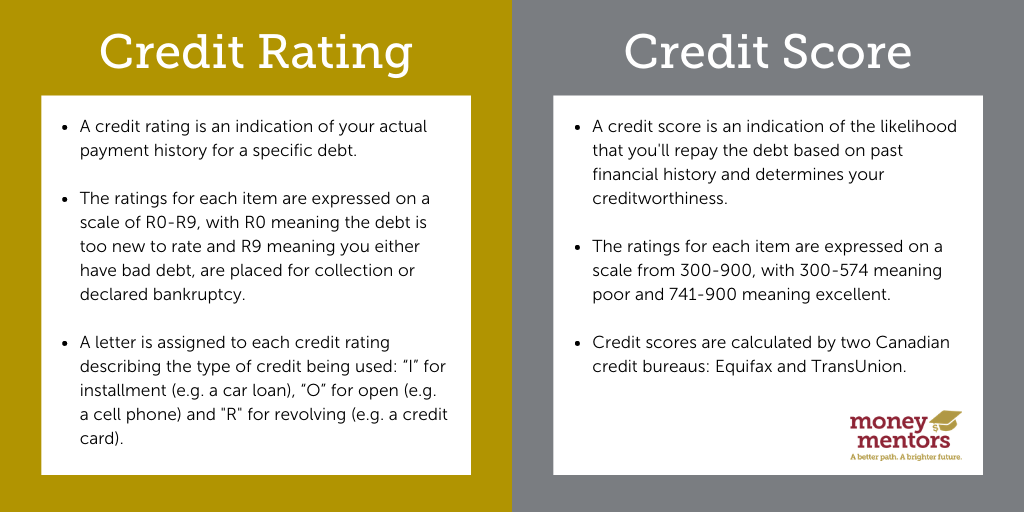

. For example Canadian credit scores range from 300-900 while US credit scores range from 300-850. Your credit score is a three-digit number that comes from the information in your credit report. Call 1-800-465-7166 for Equifax.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card. The FICO Score ranges from a minimum of 300 to a maximum or perfect score of 850. To order your credit report by phone.

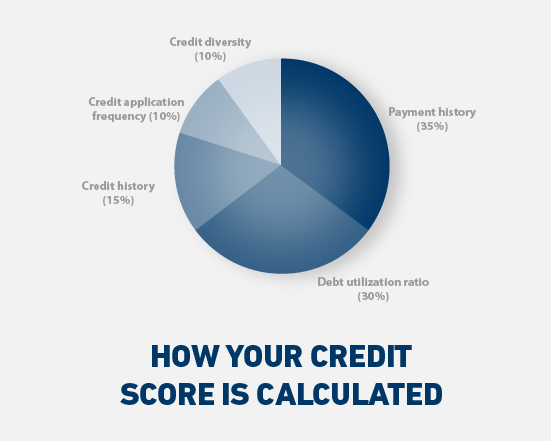

It shows how well you manage credit and how risky it would be for a lender. In Canada credit scores range from 300 just getting started up to 900 points which is the best score. However the starting credit score isnt zero.

Both Equifax and TransUnion provide credit scores for a fee. In Canada credit scores can be as high as 900 and as low as 300 but dont worry. 4 tips to rebuild your credit score after a divorce.

Plus payment activity is reported to the 3 credit bureaus Equifax Experian and TransUnion to build your credit. However this is unlikely to be your first credit score unless. Since credit scores range from 300 850 300 could be considered the starting score.

Credit scores issued by the most popular credit-scoring models in the US. Learn more about how your credit. The only thing turning 18 does in terms of your credit score gives you the ability to open a line of credit in your own name you CAN start your credit score at 18 but its not.

So what does your credit score start at once you qualify for one. Take advantage of this loan product for only 1999 per. Ideally you and your ex-spouse can figure out how to divide up the debt that was built while you shared a.

Resolve join debts and pay it off. Your credit score comes from the information in your credit report. If you want to view your credit report online for faster access you have to pay a fee.

Get your credit score. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six. Here are a few ways.

FAQs About Credit Scores. Credit scores start at 300. While both share FICOs common credit score model the average credit score in Canada.

Multiple hard inquiries within a short time indicate greater risk and can hurt your credit score. According to TransUnion 650 is the magic middle number a score above 650 will. In Canada you will get credit scores as high as 900 points as a simple starting point.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit. If youve never had credit activity a credit card or loan or instance you wont start at 300. So how can you check your credit scores.

Purchase credit scores from a Canadian credit bureau. If youre not sure what your credit score is its easy to find. In TransUnions view a score that is above 650 will likely allow you to receive a standard.

It shows how risky it would be for a lender to lend you money. Its essential to keep your score on the high end of the scale but where do you start. Most peoples credit score doesnt start at the.

Does Owing Taxes Affect Your Credit Score In Canada Hoyes Michalos

Credit Score Range What Is The Credit Score Range In Canada

Free Credit Score Free Credit Report With No Credit Card Mint

What Credit Score Do You Need To Get A Car Loan

Credit Score Range What Is The Credit Score Range In Canada

What Is A Good Credit Score In Canada And How To Improve It

How To Check Your Credit Score For Free In Canada With Verified Me Verified Me

The Beginner S Guide To Canadian Credit Scores Debtbot

Understanding Your Credit Score And Why It Matters Envision Financial

What Credit Score Do You Start With In Canada Financial Post

Building A Credit History In Canada Advice For New Immigrants

How To Build Credit In Canada Tips And Tricks Refresh Financial

What Is A Good Credit Score Nerdwallet

The Ultimate Guide To Your Credit Score In Canada Sterling Homes Edmonton

Credit And Tax Secrets Canada How To Build Your Credit And Improve Your Credit Score Fast Save Money On Your Corporate Gst Hst Payroll And Personal Tax Mahoni Bashir 9781999273118 Amazon Com Books

How Long Does It Take To Improve Credit Score In Canada Lionsgate Financial Group

What Credit Score Do You Start With In Canada Financial Post

How To Improve Your Credit Score In Canada What You Need To Know

What Credit Score Do I Need For A Mortgage Refresh Financial